Understanding Chart Patterns for Quality Trades

4 min read

In the world of trading, technical analysis serves as a powerful tool that helps traders make informed decisions. One of the most critical aspects of technical analysis is understanding chart patterns. Chart patterns are essentially visual representations of price movements over time, helping traders identify potential trading opportunities. By learning to recognize these patterns, traders can develop strategies to enter and exit trades more effectively, ultimately improving their trading outcomes. Understanding chart patterns isn’t just about predicting price movements; it’s about gaining an edge in the market. This article will walk you through the basics of chart patterns, their types, and how you can use them to make quality trades.

What Are Chart Patterns?

Chart patterns are graphical representations that appear on a price chart, providing clues about the future direction of an asset’s price. They form as a result of the collective buying and selling decisions made by market participants. When viewed over time, these price movements often follow repetitive and recognizable shapes. Chart patterns help traders identify opportunities where a continuation or reversal of the current trend is likely to occur.

There are two main types of chart patterns: continuation patterns, which signal that a trend is likely to continue, and reversal patterns, which suggest that a trend may be about to reverse. These patterns provide a roadmap for traders to follow the market’s movements, often reflecting the underlying emotions, sentiment, and psychology driving the market. For further info, learn more here.

Common Continuation Patterns

Ascending and descending triangles are common continuation patterns. An ascending triangle forms when the price creates a series of higher lows while facing resistance at a certain price level. This pattern suggests that the asset is consolidating before it breaks out in the direction of the prevailing trend, often upward. Conversely, a descending triangle forms when the price creates a series of lower highs while finding support at a particular level. This pattern typically signals that the price is likely to break downwards.

Flag patterns are small, brief consolidation phases that form after a sharp movement in price. A bullish flag appears when there is a steep upward price movement, followed by a slight downward or sideways consolidation. This indicates that the market is pausing before resuming the upward trend.

Pennants are similar to flags but are shaped like small symmetrical triangles. After a sharp price move (either up or down), the price consolidates within a converging range, forming a pennant. Like flags, pennants indicate a brief pause before the market resumes its previous trend. Traders look for breakouts in the direction of the preceding trend. Pennants, like other continuation patterns, are often confirmed by a rise in trading volume during the breakout, which suggests the market is moving with conviction.

Common Reversal Patterns

A double top forms when the price reaches a high level twice, with a moderate decline between the two peaks. This pattern suggests that the asset has encountered strong resistance and is likely to reverse downward. Traders look for a break below the intermediate low between the two peaks to confirm the reversal. A double bottom is the mirror image of a double top. It forms when the price reaches a low level twice, with a slight rebound between the two troughs. This pattern signals that the asset has found strong support and is likely to reverse upward. The reversal is confirmed when the price breaks above the intermediate high between the troughs.

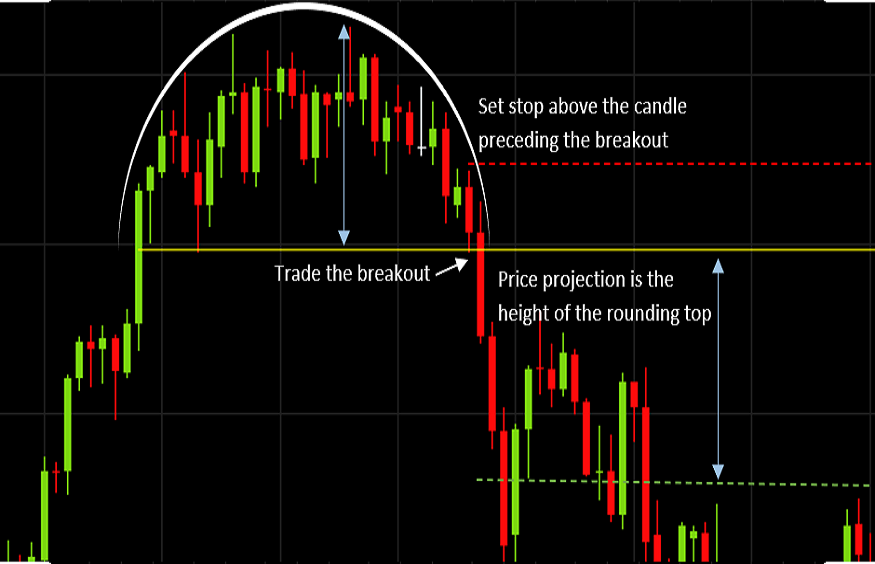

A rounding bottom, or saucer bottom, is a gradual reversal pattern that forms over a longer period. It appears as a U-shape, where the price slowly declines, flattens out, and then begins to rise again. This pattern suggests that selling pressure has slowly diminished, and buying pressure is starting to build. Rounding bottoms can indicate a significant long-term reversal from a bearish to a bullish trend. Traders often enter a trade once the price breaks above the resistance level formed at the start of the pattern.

Psychological Aspect of Chart Patterns

Chart patterns are more than just shapes on a screen; they reflect the collective psychology of traders and investors. When a pattern forms, it shows the battle between buyers and sellers, and understanding this psychology can give traders an edge.

For example, in continuation patterns like triangles, flags, and pennants, the consolidation phase often reflects market indecision. Traders are waiting for a clear signal before pushing the price in the direction of the prevailing trend. In reversal patterns like head and shoulders or double tops, traders may be gradually losing confidence in the current trend, and new market participants may be preparing to drive the price in the opposite direction.

Another important factor is volume. Volume can be a key indicator of the strength of a pattern. When a pattern is confirmed by increased volume, it suggests that more traders are entering the market, providing a higher probability of a strong move in the predicted direction.

Conclusion

Chart patterns are a vital tool in a trader’s toolkit, offering valuable insights into potential price movements. By learning to recognize continuation and reversal patterns, traders can improve their ability to make well-timed, high-quality trades. However, no pattern is foolproof, and traders should always combine chart patterns with other technical indicators and sound risk management practices.